Thorough testing and scoring process for credit cards, assessing factors like APR, fees, rewards, and benefits to provide accurate evaluations.

Using our scores as a guideline you can quickly and easily identify the credit cards that are best for you.

Below we’re going factor-by-factor so you can see exactly how we test and score credit cards.

Scoring Factors

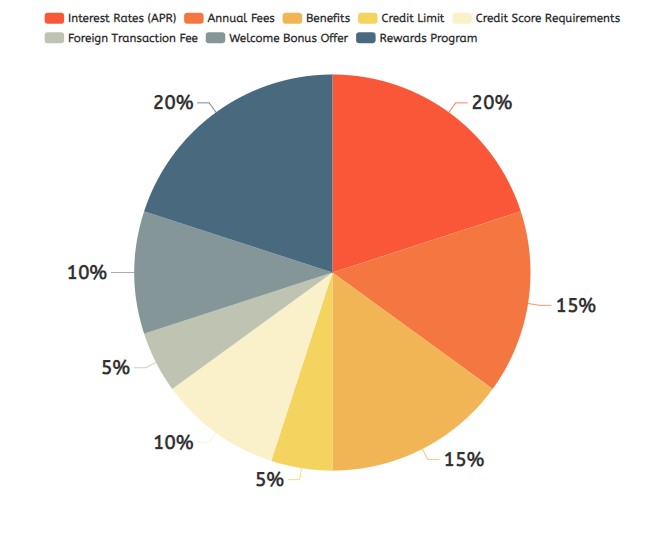

Our overall score is based on a weighted average of 8 scoring factors.

- Interest Rates (APR): 20%

- Annual Fees: 15%

- Rewards Program: 20%

- Welcome Bonus Offer: 10%

- Benefits: 15%

- Credit Limit: 5%

- Credit Score Requirements: 10%

- Foreign Transaction Fee: 5%

Each factor is given a weight based on the level of importance, which we combine together to determine the total score. Our individual factors are rounded up to one decimal place. Our overall Credit Cards scores are rounded up to the second decimal place.

Understanding Our Scores

We use a 1-10 point grading scale. The more points a credit cards scores in any given criteria, the better its performance is going to be.

- 10 – this is an exceptional score, it just doesn’t get much better than this

- 9.5-9.9 – this is an excellent score, most cards will be benefits with the performance level

- 8.5-9.4 – this a very good score

- 7.6-8.4 – this is a good score, while it’s not perfect, it’s still likely to be good enough for many users

- 6.0-7.5 – this is a fair score, depending on the factor and your desires this could be a red flag on a credit cards to avoid

- 5.1-5.9 – this is a poor score, there are significant issues

- 4.6-5.0 – this is a very poor score, there are significant issues

- <4.5 – this a failing score, there are significant issues

Credit Score Requirements

The FICO credit scoring model ranges from 300 to 850, with higher scores indicating lower credit risk and better creditworthiness. Here’s a breakdown of the score ranges and their corresponding meanings:

The FICO credit scoring model ranges from 300 to 850, with higher scores indicating lower credit risk and better creditworthiness. Here’s a breakdown of the score ranges and their corresponding meanings:

- 300 – 579: Very Poor

- 580 – 669: Fair

- 670 – 739: Good

- 740 – 799: Very Good

- 800 – 850: Excellent

Lenders use these score ranges to assess the likelihood of an individual repaying debt responsibly. It’s essential to aim for a higher score, as it can lead to better loan terms, lower interest rates, and increased access to credit products.

Both FICO and VantageScore provide free credit scores and tools that help identify bad credit and create personal finance plans.

Factors That Make Up Your FICO Credit Score

our FICO credit score is determined by several key factors, each carrying a different weight in the calculation. These factors include:

- Payment History (35%): Your history of on-time payments and any missed or late payments.

- Amounts Owed (30%): The total amount of debt you owe across all accounts and the utilization of your available credit.

- Length of Credit History (15%): The length of time your credit accounts have been open, including the age of your oldest account and the average age of all accounts.

- Credit Mix (10%): The variety of credit accounts you have, such as credit cards, installment loans, and mortgages.

- New Credit (10%): Recent inquiries for new credit and the number of recently opened accounts.

By understanding these factors and managing your credit responsibly, you can work towards improving your FICO credit score over time.

Scoring Methodology

Our Credit Card Scoring Methodology assigns a total score out of 100 to each credit card, evaluating various factors to determine its overall value proposition. Here’s a breakdown of our methodology:

- Interest Rates (APR): 20% We assess the APR for purchases, balance transfers, and cash advances to determine the cost of borrowing.

- Annual Fees: 15% We consider annual fees, late payment fees, foreign transaction fees, and other charges to evaluate the card’s affordability.

- Rewards Program: 20% We analyze the rewards structure, including earn rates, redemption options, and bonus categories, to assess the value of rewards.

- Welcome Bonus Offer: 10% We review introductory offers, such as bonus points or cash back, to determine the immediate benefits for new cardholders.

- Benefits: 15% We assess additional perks like travel insurance, extended warranties, concierge services, and airport lounge access to evaluate the card’s overall value.

- Credit Limit: 5% We consider the credit limit offered based on the applicant’s creditworthiness and financial situation.

- Credit Score Requirements: 10% We examine the minimum credit score required for approval to assess the card’s accessibility.

- Foreign Transaction Fee: 5% We evaluate the quality of Foreign Transaction Fee, It typically ranges from 1% to 3% of the transaction amount.

Our methodology ensures a comprehensive evaluation of credit cards, providing consumers with valuable insights to make informed decisions based on their individual preferences and financial goals.

Suggestions

Do you have a suggestion for how we could make our scoring system better? Please send main to [email protected].