Best for

- Travelers

- Frequent Flyers

- Hotel Stays

- Foreign Travel

- Rewards Points Enthusiasts

Considerations

- Annual Fee

- Foreign Transaction Fee

- Sign-Up Bonus

- Benefits (Travel Insurance, Purchase Protection, etc.)

Pros

- No reward caps

- No booking fees

- Unlimited rewards seats

- 3,000 points every year on your Cardmember anniversary

Cons

- Very high balance transfer fee

- 3% Foreign transaction fee

- Annual fee

- No introductory APR

- Membership fees

- 50+ Credit Cards Ranked

- 2000 Data Points Collected

- 10 Levels of Rank Checking

- 25+ Categories Considered

At MyCreditCardLab, we value your trust above all else. We earn it with careful, fair analysis. We are fully transparent. We stick to strict editorial standards and independence. Your confidence in our content is our top priority.

See our full methodologyIn This Review

Review: Southwest Rapid Rewards® Plus Card

Get in-depth credit card reviews covering features, benefits, fees, and rewards. Make informed decisions and find the perfect card for your financial goals.

For more information see our credit card score explanation here.At Lootrs, we put each card to the score.

We score Southwest Rapid Rewards® Plus Card 10 different factors that impact the benefits and rewards of the cards. scoring categories include:

| Credit Cards Review | Rating |

|---|---|

| Intro APR | Fair |

| Regular APR | Good |

| Annual Fee | Very Good |

| Welcome Bonus | Good |

| Rewards | Very Good |

| Benefits | Very Good |

| Recommended Credit Score | Very Good |

| Foreign Transaction Fee | Very Good |

| Cash Advance Fee | Very Good |

| Balance Transfer Fee | Good |

Who can apply for Southwest Rapid Rewards® Plus Card?

We have categorized Southwest Rapid Rewards® Plus Card 4 main useful user criteria. it's applied using the Lootrs methodology.

How is Southwest Rapid Rewards® Plus Card Different?

On the bright side, Southwest points are very valuable. This is clear when you strictly compare them to airline points and miles.

| Rewards program | Value | Estimated value of 30,000 points/miles |

| Southwest Rapid Rewards | 1.5 cents | $450 |

| JetBlue TrueBlue | 1.3 cents | $390 |

| Delta SkyMiles | 1.2 cents | $360 |

| United Airlines MileagePlus | 0.9 cents | $270 |

Southwest Rapid Rewards® Plus Card Annual Fee

Card type: Airline Credit Cards

Issuer Name: Chase

$69 annual fee

The card's annual fee is modest, at just $69. This is lower than many competing travel and airline cards. These anniversary points are a great deal. Their value almost covers your whole annual fee.

Welcome Bonus

This is a limited-time offer: You can earn a Companion Pass® good through 2/28/25. You can also earn 30,000 points after you spend $4,000 in the first 3 months from account opening.

APRs: Southwest Rapid Rewards® Plus Card

Explore credit card APRs to understand borrowing costs. Learn how APRs vary for purchases, balance transfers, and cash advances. This is crucial for informed financial choices.

The table below shows the types of each APR brief description for the Southwest Rapid Rewards® Plus Card.

| Type of APR | Rating |

|---|---|

| Intro APR - No intro offer available | 7/10Fair |

| Regular APR - 21.49% - 28.49% Variable APR | 8.4/10Good |

| Purchase - 21.49% - 28.49% Variable APR | 8.5/10Very Good |

| Balance transfer - 21.49%–28.49% variable, plus a fee of either $5 or 5% of the amount of each transfer, whichever is greater | 7.8/10Good |

| Cash advance - 29.99% variable, plus a fee of either $10 or 5% of the amount of each transaction, whichever is greater | 9/10Very Good |

| Penalty - Up to 29.99% | 8.9/10Very Good |

Southwest Rapid Rewards® Plus Card Benefits

Certainly! Here's a table. It shows the benefits of the Southwest Rapid Rewards® Plus credit card:

| Benefits | Score |

|---|---|

| Various protections and perks There are enough perks to justify keeping the card year after year. The lost luggage reimbursement and baggage delay insurance can reimburse you. They give you peace of mind when traveling. So can the extended warranty and purchase protection. The anniversary point bonus and EarlyBird check-ins also make it worthwhile. |

9.1/10Very Good |

| Redemption flexibility There aren’t any blackout dates, so you can use your rewards points whenever you choose. |

9/10Very Good |

| 25% back on inflight purchases You’ll get a nice discount on any inflight purchases. This includes drinks, meals, and internet access. |

9.4/10Very Good |

| Extended warranty protection Southwest Plus cardholders can add a year to the original warranty on eligible purchases made with the card. They can do this up to $10,000 per claim. |

9.1/10Very Good |

| Baggage delay insurance This benefit provides reimbursement for emergency purchases of essential items. It applies when your baggage is delayed for over six hours. It covers up to $100 per day for a maximum of three days. |

9.3/10Very Good |

| 2 EarlyBird check-ins each year You’ll get a pair of credits you can use for early check-ins twice per year. This lets you check in automatically before the typical 24-hour check-in. It lets you get an earlier boarding position and a better chance to pick your seat and store your bags. EarlyBird check-in typically costs between $15 and $20. |

9.2/10Very Good |

Southwest Rapid Rewards® Plus Card Rewards

Southwest Rapid Rewards® Plus Card Rewards program provides exceptional flexibility in credit currency. Redeem your earnings across a wide range of options, including:

- Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- 3,000 anniversary points each year.

- Earn 2X points on Southwest® purchases.

- Earn 2X points on local transit and commuting, including rideshare.

- Earn 2X points on internet, cable, and phone services; select streaming.

- 2 EarlyBird Check-In® each year.

- Earn 1 point for every $1 spent on all other purchases.

- Member FDIC

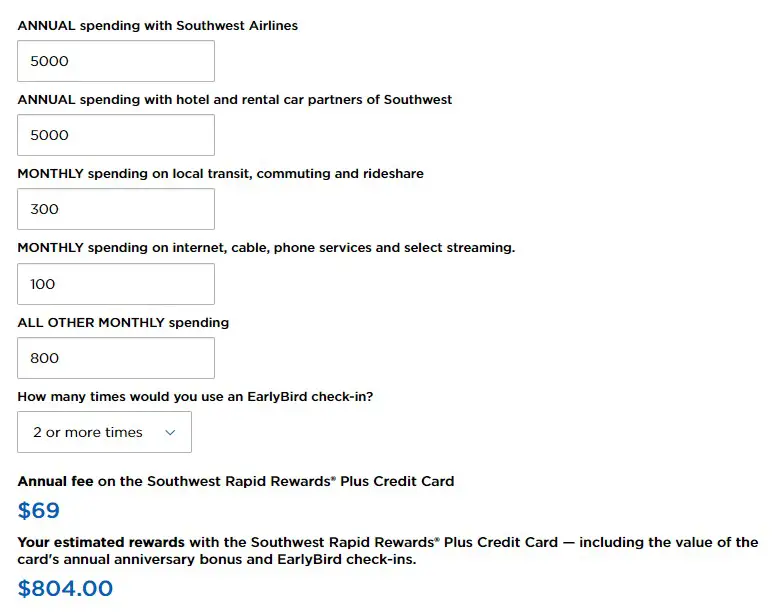

Southwest Rapid Rewards Plus Credit Card rewards potential

We estimate that a U.S. household that wants this card has an income of $84,352 and $25,087 in expenses they can charge to a credit card. We used government data and other public information for this estimate. Here’s a break-down of how many rewards the average cardholder can expect to earn:

- $2,100 in spending on flights x 2 points = 4,200

- $1,000 in spending on hotels x 2 points = 2,000

- $500 in spending on public transit x 2 points = 1,000

- $1,200 on phone and internet x 2 points = 2,400

- $500 on streaming x 2 points = 1,000

- $12,000 x 1 point = 12,000

This adds up to 22,600 reward points per year.

Southwest Rapid Rewards® Plus Credit Card: Is it worth the annual fee?

Tell us your spending with the Southwest Rapid Rewards® Plus Credit Card. We’ll estimate your rewards and say if they’ll make up for the $69 annual fee.

Southwest Plus redemption options

Wanna Get Away fare = 1.6

Anytime fare = 1.1

Business Select fare = 0.9

Gift cards = 0.7

Car rentals= 0.7

International flights = 0.8

Merchandise = 0.6

Hotel = 0.2

Experiences = 0.8

Recommended Credit Score

Credit Score : 690 - 850 (Fair - Exceptional)

We evaluate credit card options based on FICO credit scores. We ensure tailored recommendations that match your financial profile.

For more information see our FICO Recommended credit score Rating explanation here.For the Southwest Rapid Rewards® Plus Card, applicants with credit scores between 690 (Fair) and 850 (Exceptional) are ideally suited. This range ensures eligibility for customized benefits and rewards that align with your credit profile. Apply now to unlock exclusive perks and elevate your credit card experience with us.

Compare The Southwest Rapid Rewards® Plus Card vs. Other Popular Cards

Compare credit cards effortlessly to find the ideal match for your financial goals. Explore features, rewards, fees, and more to make informed decisions and maximize your benefits. You might want cash back, travel rewards, or low APR. Our tool makes it easy. It lets you compare many cards at once.

You have comprehensive information at your fingertips. You can select the card that best fits your spending and preferences. Take control of your finances. Find the perfect credit card for your needs with our easy comparison platform.

Southwest Rapid Rewards® Plus Card

Southwest Rapid Rewards® Plus Card

|

Ink Business Preferred® Credit Card

Ink Business Preferred® Credit Card

|

Capital One VentureOne Rewards Card

Capital One VentureOne Rewards Card

|

|---|---|---|

| 8.5MyCreditCardLab Score |

8.8MyCreditCardLab Score MyCreditCardLab Score 8.8We've meticulously evaluated this card using MyCreditCardLab's exclusive credit card rating system. Our assessment considered various cardholder needs, ultimately assigning a rating based on the need with the highest score, currently at "." Our rating scale ranges from 1 to 10, with 10 representing the best possible score. |

9.3MyCreditCardLab Score MyCreditCardLab Score 9.3We've meticulously evaluated this card using MyCreditCardLab's exclusive credit card rating system. Our assessment considered various cardholder needs, ultimately assigning a rating based on the need with the highest score, currently at "." Our rating scale ranges from 1 to 10, with 10 representing the best possible score. |

| ANNUAL FEE | ||

| $69 | $95 | $0 |

| INTRO APR | ||

| N/A | N/A | 0% on Purchases and Balance Transfers for first 15 months |

| REGULAR APR | ||

| 21.49% - 28.49% Variable APR | 21.24% - 26.24% Variable APR | 19.99% - 29.99% Variable APR |

| WELCOME BONUS | ||

| 30,000 points after you spend $4,000 on purchases in the first 3 months from account opening | 100,000 bonus points after spending $8,000 on purchases in the first three months from account opening | 20,000 Miles once you spend $500 on purchases within 3 months from account opening |

| REWARDS | ||

| 2X points on Southwest purchases | 3X points on the first $150,000 spent on travel and select business categories each account anniversary year | 5X miles on hotels and rental cars |

| BENEFITS | ||

| Southwest purchases and hotel | Small business, Travel | Traveler |

| CASH ADVANCE FEE / APR | ||

| 5% (min $10) / 29.99% | 5% (min $15) / 29.99% | 5% (min $5) / 29.99% |

| BALANCE TRANSFER FEE | ||

| Either $5 or 5% of the amount of each transfer, whichever is greater. | Either $5 or 5% of the amount of each transfer, whichever is greater. | 3% for the first 15 months, after 4% of the amount of each transfer |

| RECOMMENDED CREDIT SCORE | ||

| 690 - 850 (Fair - Exceptional) | 690 - 850 (Fair - Exceptional) | 690 - 850 (Fair - Exceptional) |

| FOREIGN TRANSACTION FEE | ||

| 3% | $0 | $0 |

| BEST FOR | ||

|

|

|

| More Details Compare | More Details Compare |

Chase Visa Login

Follow these easy steps:

Step 1. Go to the Login Chase Visa page via the official link.

Step 2. Log in using your username and password. The login screen appears upon successful login.

Step 3. If you still can’t access Chase Visa Login then see forgot your username and password option.

Frequently Asked Questions (FAQs)

Still have questions? Check out some of the top FAQs on the Southwest Rapid Rewards® Plus credit card below and get the answers you're looking for.

The points you need to book a flight depend on many factors. These include the destination, time of day and date, demand, and fare type. Keep in mind that flights are never entirely free, even when redeeming miles.

Yes. The Southwest Rapid Rewards Plus card costs $69 each year. But, the fee is fully covered by the value of the 3,000-point anniversary bonus. You also get two free EarlyBird Check-In® boarding upgrades each year.

You would only need to spend about $206 per month on 2X bonus category purchases. This would cover the annual fee with rewards. So, the fee is worth it for frequent Southwest flyers.

Rapid Rewards Dining is a rewards program within the Rapid Rewards program. This features lets members earn points from dining with select Southwest restaurant partners.